In the era of remote work, digital nomads, and cross-border collaborations, one challenge remains stubbornly outdated for many businesses: invoicing. While teams can be global in seconds, managing payments across currencies, tax codes, and compliance laws is often a slow and frustrating experience.

At Emerald24, we believe invoicing shouldn’t be a bottleneck — it should be a bridge.

The global shift: why invoicing needs to evolve

Invoicing isn’t just about sending a PDF with a number on it. It’s about:

- Ensuring accuracy across currencies

- Complying with regional tax regulations (e.g., VAT, GST)

- Reconciling payments in multiple banking systems

- Communicating clearly between clients and vendors who may never share a time

Invoicing for global teams is no longer just a finance task — it’s a cross-functional challenge that touches operations, compliance, client communication, and even product delivery.

Manager at a SaaS startup

The rise of remote-first companies and freelance economies has made manual invoicing processes feel painfully obsolete. It’s time for change.

The challenges global

teams face

Managing invoices within a single country is already a task that demands precision, timing, and structure. Now, imagine adding five time zones, four currencies, three tax jurisdictions, and two different languages into the mix. That’s the reality for most modern global teams. Read the article

For companies operating across borders — whether they’re startups with remote staff or enterprises with distributed client networks — invoicing often becomes a slow, error-prone process. What seems like a simple transaction can quickly become a complex, manual workflow that holds back growth.

Here are some of the most common — and costly — face when handling invoicing:

1. Currency conversion issues

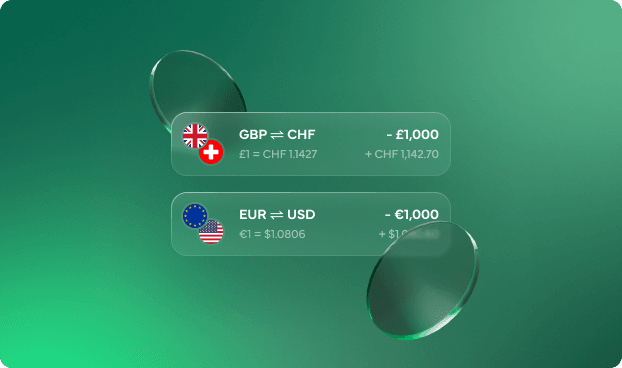

- When sending or receiving invoices internationally, currency mismatches can lead to discrepancies in expected payment.

- Many businesses rely on manual conversions, which often result in exchange rate inconsistencies or unexpected shortfalls.

- Clients and partners may also be confused about which currency to use, especially if no clear guidance is provided in the invoice.

2. Tax & regulatory complexity

- Different countries require different invoice formats, including tax IDs, registered business details, and compliance clauses.

- Some jurisdictions require specific VAT or GST structures, or even digital reporting for every invoice issued.

- Without proper tax handling, companies risk non-compliance — which can lead to fines, audits, or payment delays.

3. Lack of unified tools

- In many global teams, invoicing is scattered across spreadsheets, PDFs, and third-party tools.

- This fragmentation creates bottlenecks, especially when multiple departments (like finance, ops, and legal) need access to the same data.

- As a result, teams waste time on double-checking information, reconciling records manually, and chasing approvals.

4. Slow reconciliation

- After invoices are sent, the waiting game begins — but so does the risk of things falling through the cracks.

- Payments are often received without clear references, or go unnoticed because no one updated the invoice status.

- Teams must rely on manual tracking and emails to confirm who paid what and when — a process that’s both outdated and unreliable.

In a global team, even a small invoicing error can take days to resolve, especially when time zones don’t align. Without the right tools, it’s not just slow — it’s chaotic.

Manager at a SaaS startup

These issues don’t just waste time — they create friction between teams, hurt client relationships, and slow down cash flow. In a fast-paced global economy, businesses can’t afford to have invoicing drag behind.

5 ways Emerald24 simplifies global invoicing

Traditional invoicing platforms weren’t built with global operations in mind. They assume a single-currency workflow, flat tax systems, and basic payment logic. That might work for small local businesses — but for international teams, it falls apart fast. That’s where Emerald24 makes a real difference.

Our invoicing system is designed specifically to support cross-border collaboration, multinational payments, and remote-first operations. We don’t just digitize invoices — we rethink how invoicing works in a globally connected world. Here are five concrete ways Emerald24 simplifies global invoicing:

- Multi-currency invoicing, natively:Send and receive invoices in multiple currencies — including USD, EUR, GBP, and UAH — with automatic real-time exchange rate integration. Your clients see exactly what they owe in their preferred currency, while your finance team tracks everything in your home currency

Sourse - Smart Tax Handling:Emerald24 detects the location of both the sender and the recipient and applies tax rules accordingly. Whether it’s VAT in the EU, GST in Canada, or zero-rated exports, your invoice will meet the local compliance standards — no manual input requiredSourse

- Centralized Dashboard for Teams:All invoice data lives in one intuitive platform. Multiple departments — from accounting to operations — can collaborate, add notes, tag teammates, and approve invoices without leaving the platform. Say goodbye to endless email threads and scattered files.

Sourse - One-Click Payment Integration:Invoices generated in Emerald24 include secure embedded payment links. Clients can settle invoices via bank transfer, card, or even cryptocurrency (if enabled). Once paid, the invoice status updates automatically in your dashboard.

Sourse - Auto-Reconciliation and Smart Alerts:Emerald24 tracks incoming payments in real time and matches them to the correct invoice. If a payment is missing or delayed, you get a smart alert — not a messy Excel sheet. Reporting becomes seamless, and month-end closing takes a fraction of the time.

Sourse

The rise of remote-first companies and freelance economies has made manual invoicing processes feel painfully obsolete. It’s time for change.

What this means for your team

When invoicing is simplified, your entire team feels the difference — not just your finance department. With Emerald24, global teams can finally shift their focus away from manual tasks and uncertainty, and toward what really matters: delivering value to clients, scaling operations, and growing revenue.

Instead of chasing payments, correcting invoice errors, or worrying about currency mismatches, your team can rely on a streamlined system that simply works in the background — accurately and compliantly. This means:

- Faster payments

- Less friction across departments

- Global readiness

- Reduced human error

It empowers your team to move faster, collaborate better, and build trust with international partners through timely, transparent, and accurate financial communication. And when your invoicing works — your entire business flows better.

Final thoughts

Invoicing may seem like a simple administrative function, but in the context of global teams, it becomes a foundational element of operational success. When your team is spread across continents, time zones, and jurisdictions, the systems you rely on need to be more than just functional — they need to be intelligent, adaptive, and dependable.

At Emerald24, we see invoicing not just as a financial process, but as a core part of the relationship between people and companies — one that communicates professionalism, builds trust, and ensures momentum doesn’t stall due to inefficiencies or avoidable errors.

By removing friction from the invoicing workflow, we help teams focus on what they do best: creating, building, collaborating, and growing — without getting bogged down in currency conversions, regulatory confusion, or delayed payments.

We didn’t set out to reinvent invoicing — we set out to solve the real problems that growing, global teams face every day. What we’ve built is more than a tool — it’s an ecosystem that brings clarity, speed, and trust into one of the most critical parts of doing business internationally.

Manager at a SaaS startup

It empowers your team to move faster, collaborate better, and build trust with international partners through timely, transparent, and accurate financial communication. And when your invoicing works — your entire business flows better.