Global payment services

for UAE entrepreneurs

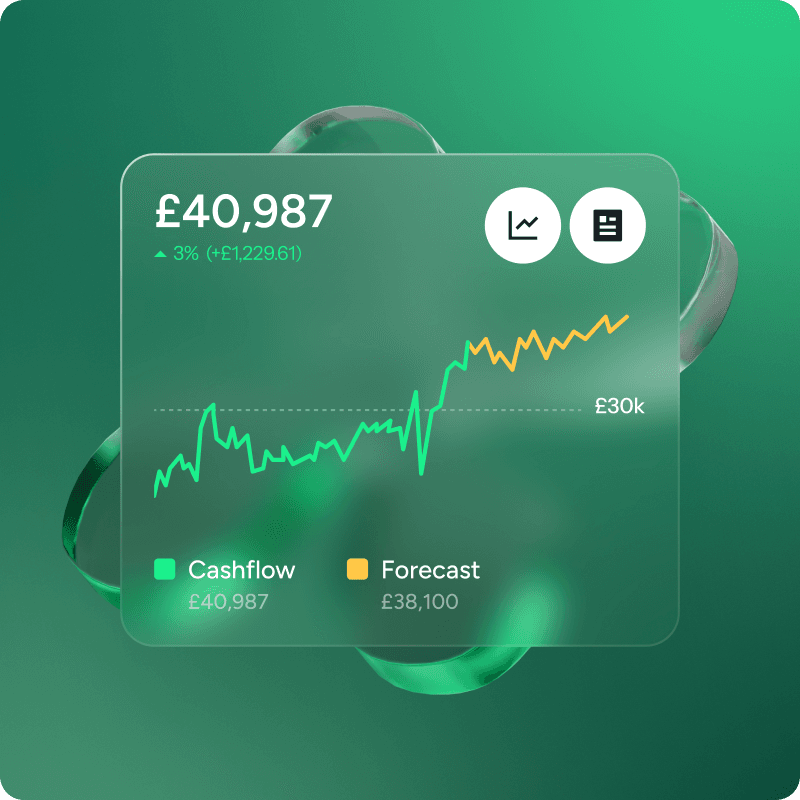

Our intelligent services built for business

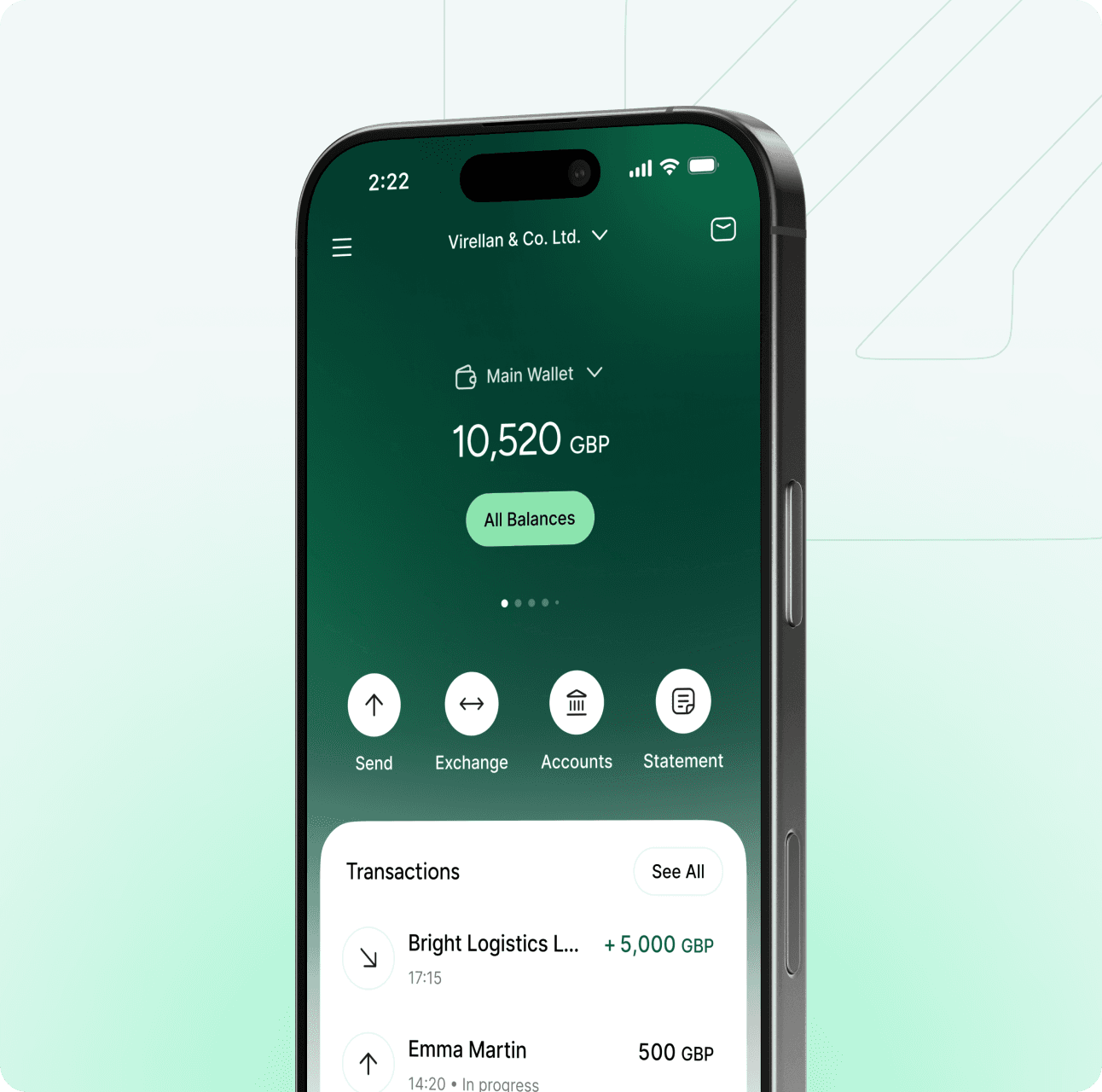

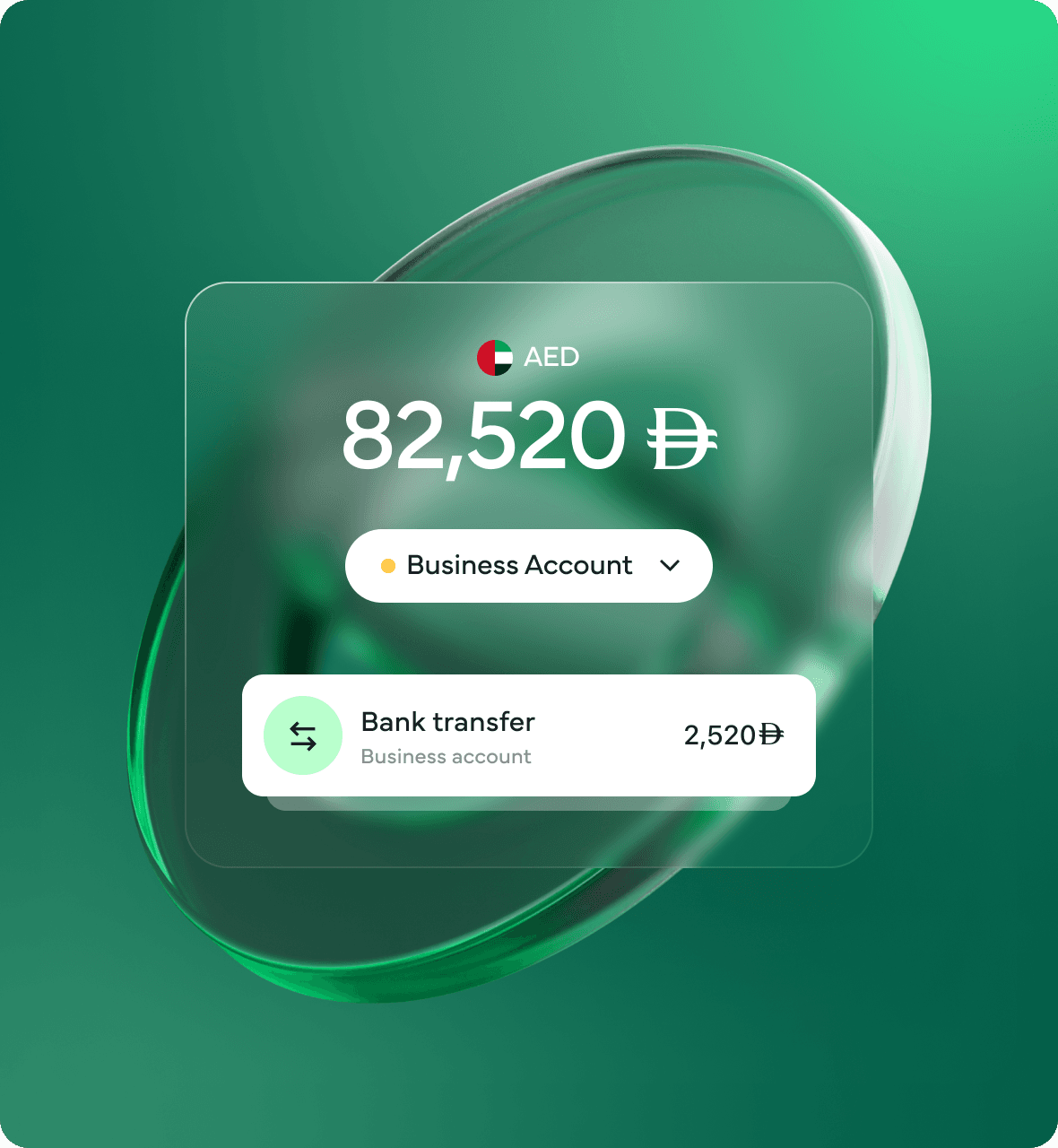

Accounts

Smart and flexible accounts, designed to support your business across borders and industries.

- Multi-currency GB IBANs – EUR, USD, AED, CHF and more

- Fast, fully digital onboarding through our platform

- Dedicated support for international and UAE-based businesses

- Manage your accounts securely via web or mobile

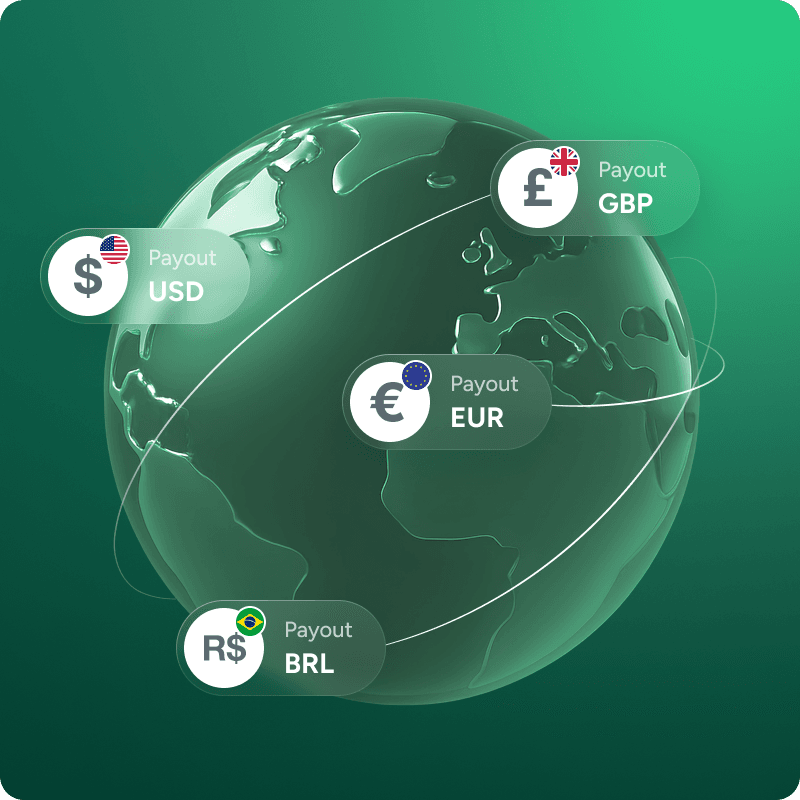

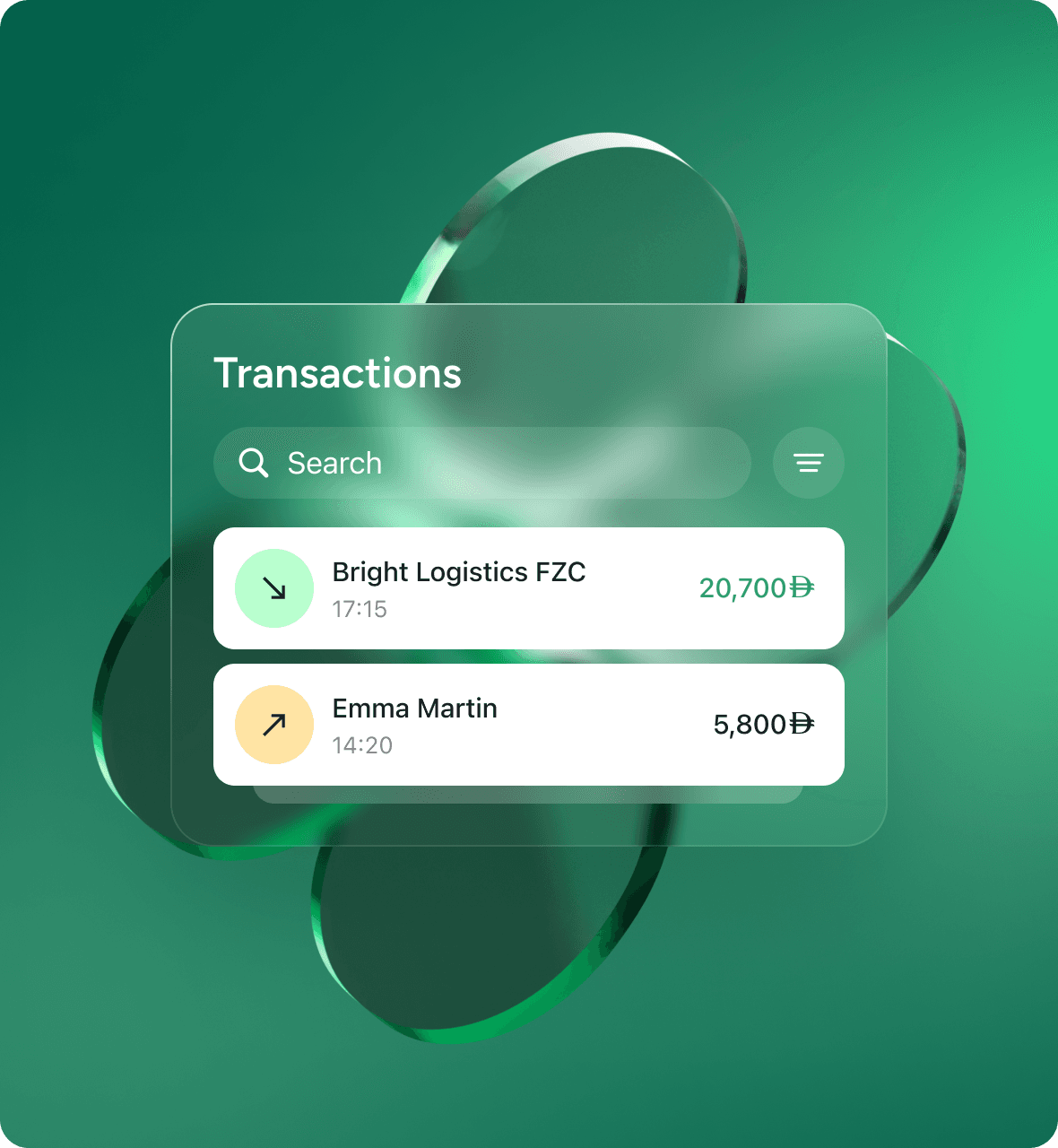

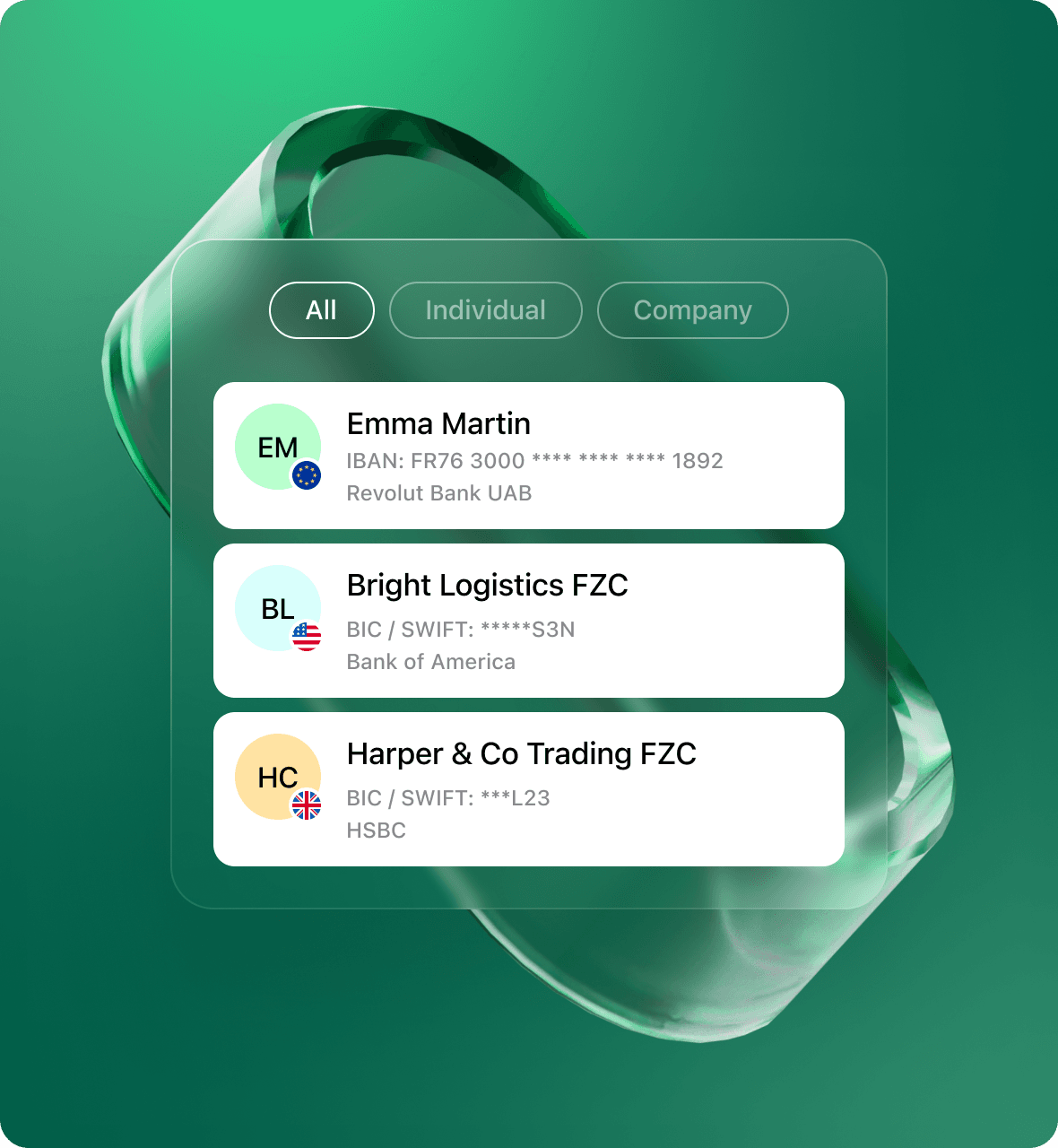

Payments

Reliable and intelligent payment solutions for businesses with local and international needs.

- Send and receive payments in all major currencies

- Access to local payment rails — FPS, CHAPS, Bacs, and Direct Debit

- International transfers in EUR, USD, CHF, AED and more

- Tailored solutions for complex payment structures, with dedicated support

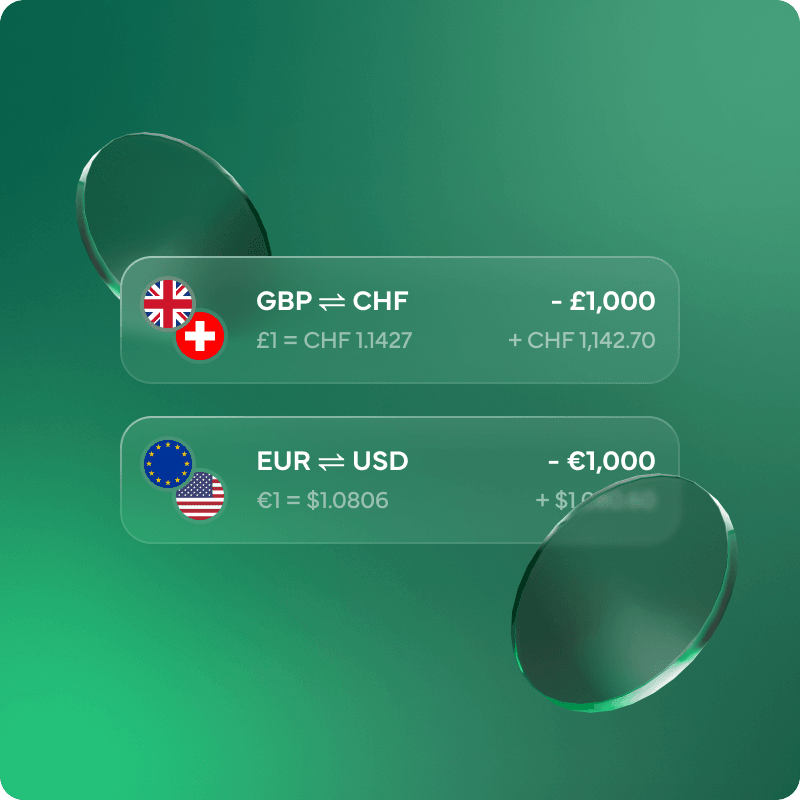

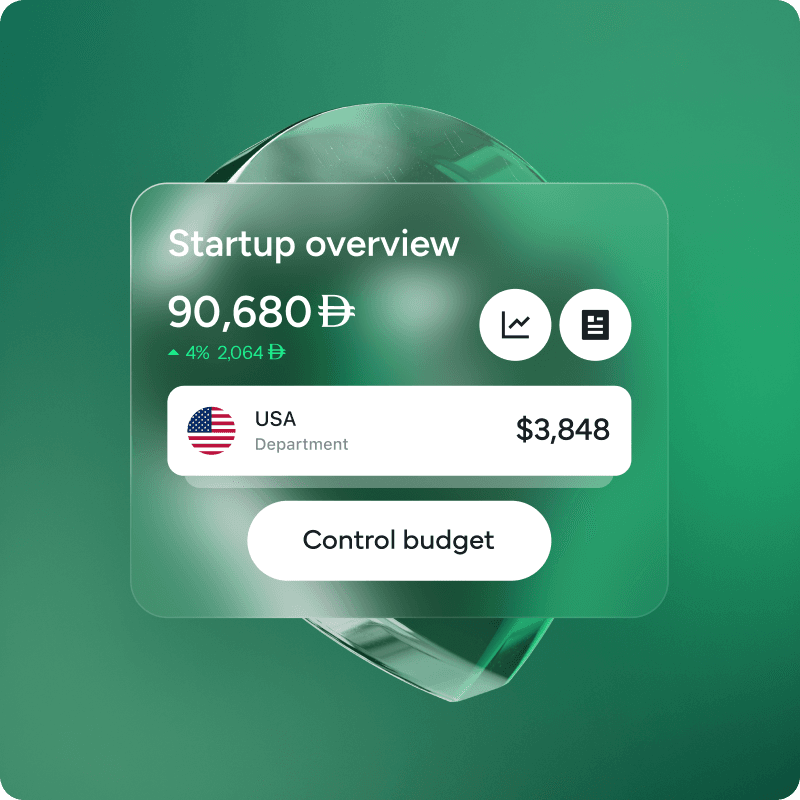

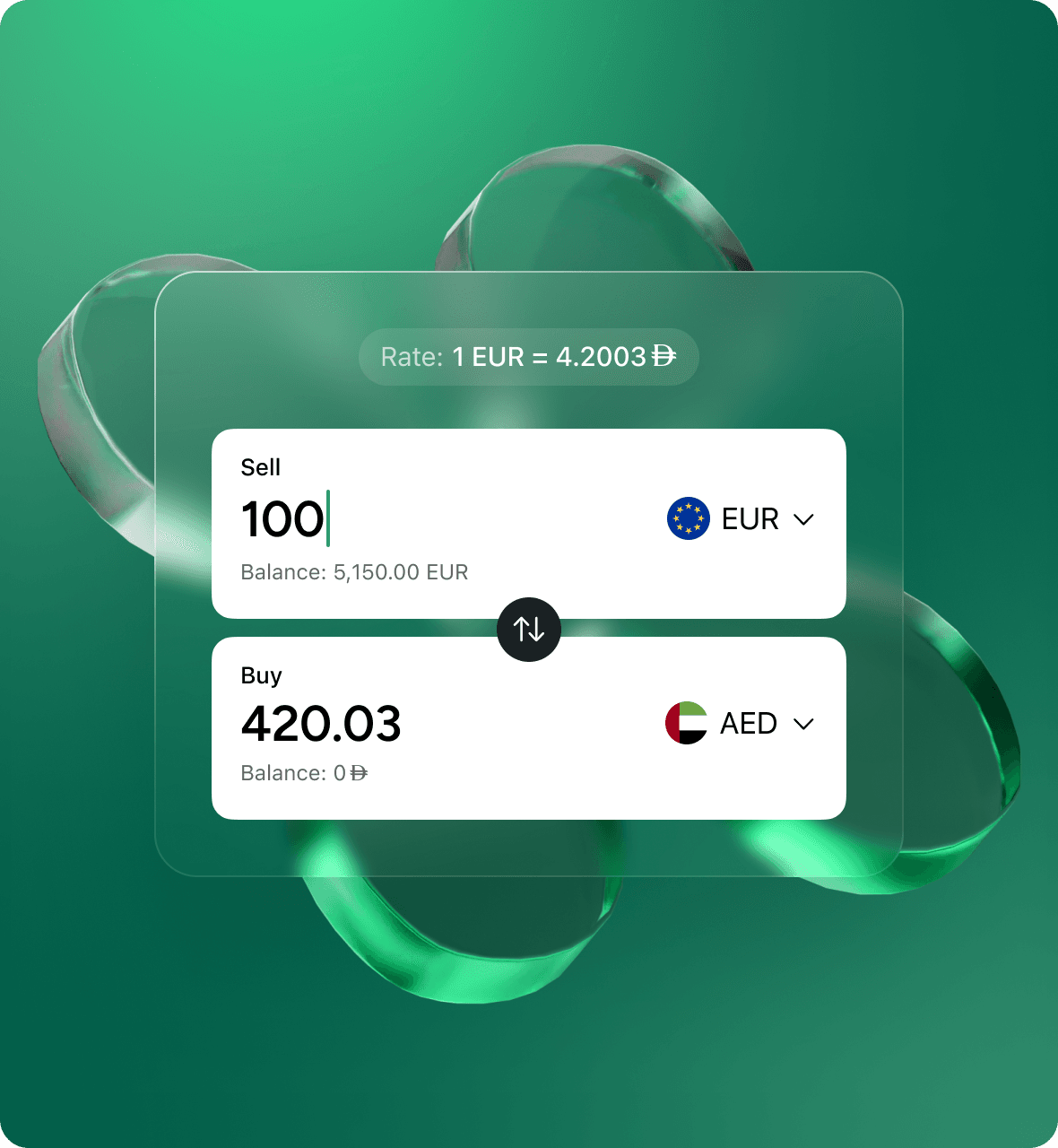

Currency exchange

All the currencies you need, with competitive FX rates and platform visibility.

- Buy, sell, hold, pay, and receive in 30+ currencies

- Pre-agreed individual rates available for higher FX volumes

- Instant execution through your Emerald24 platform

- Integrated directly into your business account

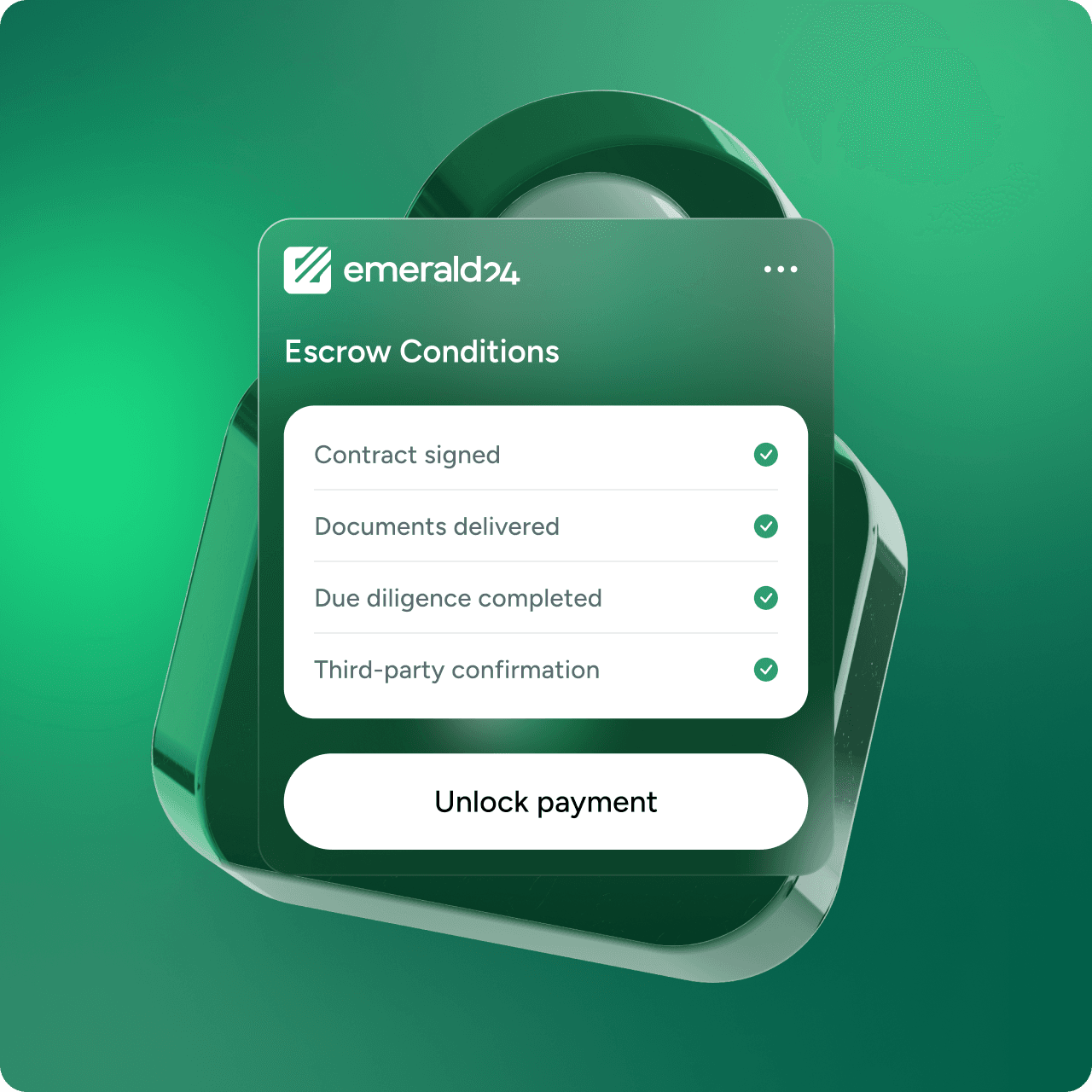

Escrow Accounts

Secure settlements for complex deals. Payments are released only when agreed conditions are met, giving all parties transparency and protection in complex transactions.

- Real estate purchases and transfers

- Business deals, mergers, and acquisitions

- Sale or purchase of company shares

- Other agreements requiring conditional settlement

Acquiring

Accept online card payments from customers worldwide — with straightforward integration and expert support.

- Merchant accounts for e-commerce businesses

- Transparent pricing and settlement terms

- Support for major global card schemes

- Secure payment gateway

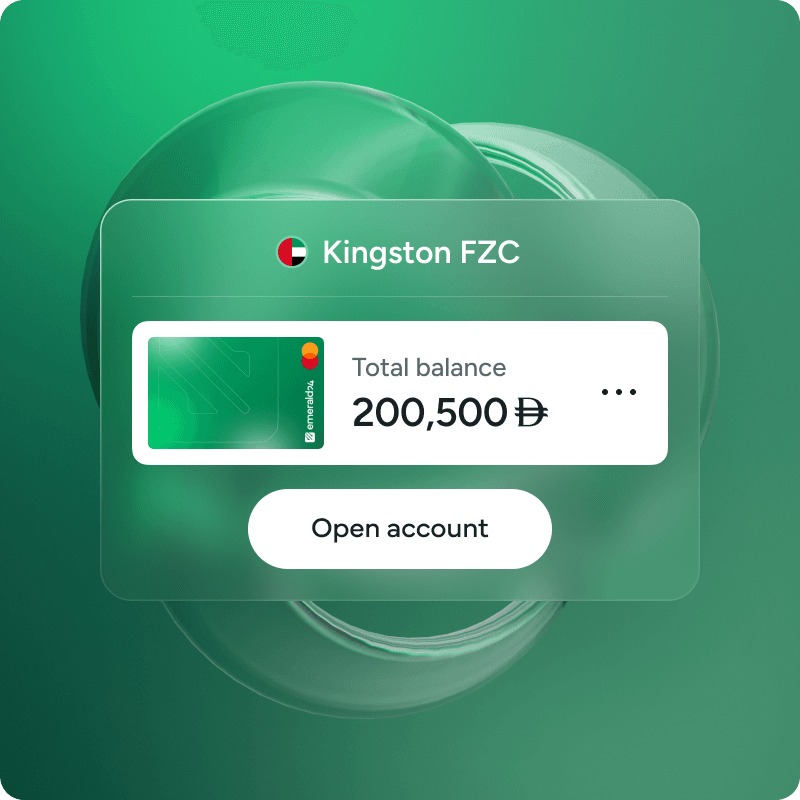

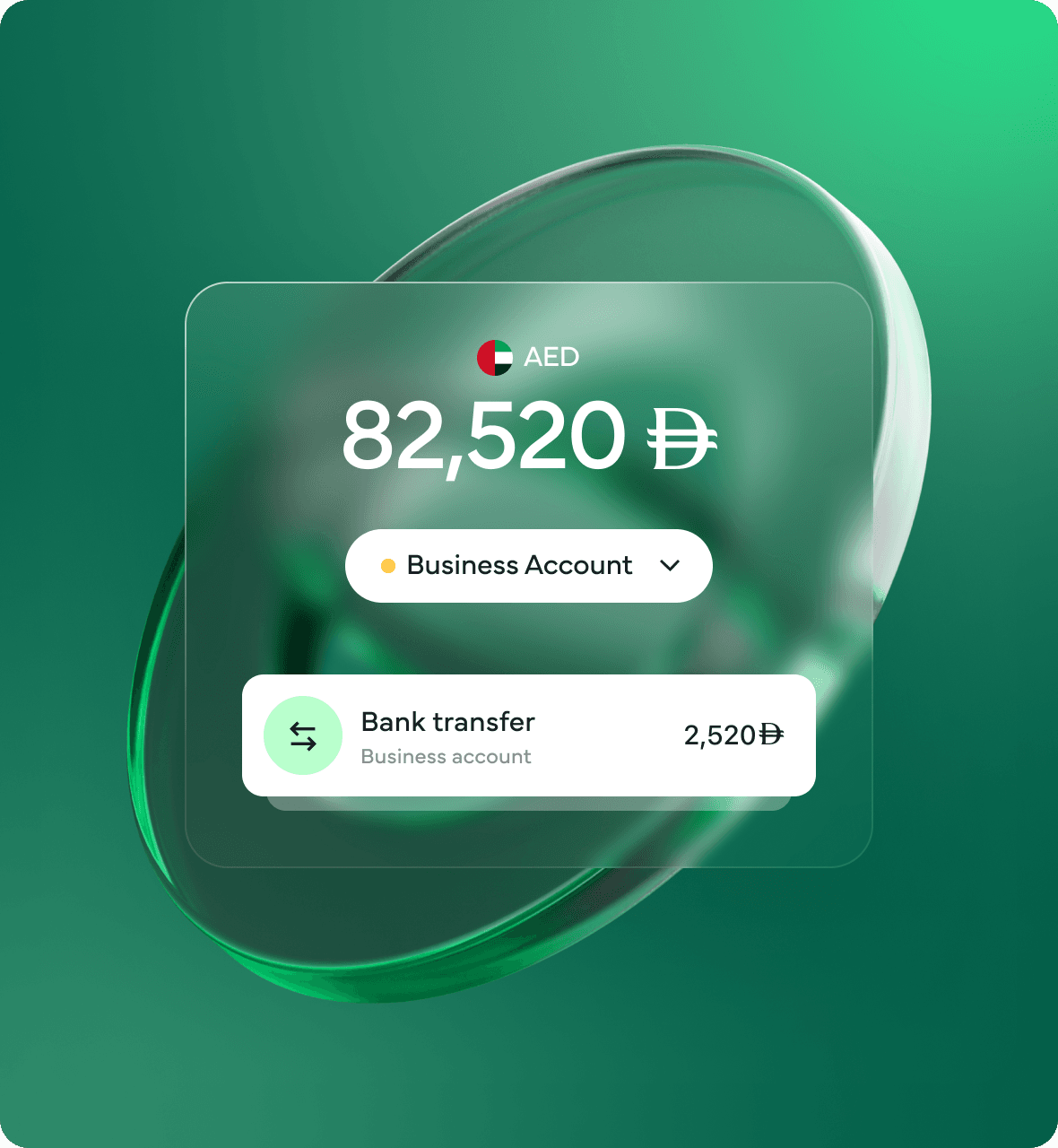

Accounts

Smart and flexible accounts, designed to support your business across borders and industries.

- Multi-currency GB IBANs – EUR, USD, AED, CHF and more

- Fast, fully digital onboarding through our platform

- Dedicated support for international and UAE-based businesses

- Manage your accounts securely via web or mobile

Payments

Reliable and intelligent payment solutions for businesses with local and international needs.

- Send and receive payments in all major currencies

- Access to local payment rails — FPS, CHAPS, Bacs, and Direct Debit

- International transfers in EUR, USD, CHF, AED and more

- Tailored solutions for complex payment structures, with dedicated support

Currency exchange

All the currencies you need, with competitive FX rates and platform visibility.

- Buy, sell, hold, pay, and receive in 30+ currencies

- Pre-agreed individual rates available for higher FX volumes

- Instant execution through your Emerald24 platform

- Integrated directly into your business account

Escrow Accounts

Secure settlements for complex deals. Payments are released only when agreed conditions are met, giving all parties transparency and protection in complex transactions.

- Real estate purchases and transfers

- Business deals, mergers, and acquisitions

- Sale or purchase of company shares

- Other agreements requiring conditional settlement

Acquiring

Accept online card payments from customers worldwide — with straightforward integration and expert support.

- Merchant accounts for e-commerce businesses

- Transparent pricing and settlement terms

- Support for major global card schemes

- Secure payment gateway

Built on regulation, experience & integrity

Services made for your business

Technology that works — people who care

Where our approach

makes the difference

Ready to take the next step with Emerald24 in the UAE?

Building partnerships in the UAE

Join our network of trusted introducers in the UAE and earn

competitive rewards while helping local entrepreneurs

access international financial solutions.

Got questions?

We’ve got the answers.

Contact our team

Fill in the form and we’ll make sure your enquiry reaches the right person.